Monday, 31 July 2017

Friday, 28 July 2017

What Caused The Mid-Day Selloff?

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

The most likely “cause” of the midday reversal and selloff (which frankly looked ugly for an hour or so) was a cautious report from JPM quant analyst Kolanovic, and the reasons it caused a dip are twofold. First, Kolanovic is very respected on the Street, and he was one of the first analysts to correctly identify the role of “Risk Parity” funds in the violent market declines of August 2015.

Second, he outright suggested investors hedge equity exposure.

Now, to be clear, it wasn’t a bearish report, as he did note there are strong, positive fundamental factors supporting stocks including a rising economic tide and growing earnings.

However, he made the point that, in his opinion, market volatility is now at an all-time low. The specific accuracy of this claim can be debated, but let’s all agree market volatility is close to, if not at, all-time

lows.

The all-time lows in volatility have caused funds to use increasingly leveraged strategies to generate outsized returns. Selling volatility options is one of the simplest leveraged strategies, but the point is this: Quant funds and traders will ratchet-up leverage in low volatility environments to increase returns amidst perceived lower risk. And, since volatility is at or near all-time lows (and has been for some time) these leveraged strategies are both abundant and large.

And, this all-time low volatility and explosion of leveraged strategies is coming right at a time when global central banks are reducing monetary accommodation for the first time in, well, a decade.

So, while the analogy of fireworks sitting on top of a powder keg is a bit over the top, it does illustrate the general idea behind Kolanovic’s caution.

Bottom line, in my opinion, this report by itself isn’t a reason to materially de-risk, as the same argument could have been made about this market over the past few months (as it’s made new highs). But, Kolanovic is a smart guy, so his caution should be noted.

Finally, two anecdotal points. First, I believe what really spooked markets yesterday was that Kolanovic referenced this current set up as being similar to “Portfolio Insurance,” a strategy that failed miserably and contributed to the crash of 1987. Obviously, that’s not an uplifting analogy.

Second, for those of us watching the tape yesterday, the mini-freefall we saw in tech and specifically SOXX and FDN, was a bit unnerving. Things steadied, but the pace of the declines midday yesterday was a bit scary. That tells me these are very, very crowded trades, and I am going to have a “think” on potentially lightening up some exposure to that tech sector in favor of shifting it internationally (Europe, Japan, and perhaps emerging markets). Food for thought.

Getting back to the markets today, the Employment Cost Index is the key number to watch. If it’s hot, we could see yields rise, and that might pressure stocks mildly. Meanwhile, a soft reading will send yields lower and likely push stocks higher short term. Inflation remains a much more important influence on the markets right now than measures of economic growth.

Time is money. Spend more time making money and less time researching markets every day—start your free trial of the Sevens Report now.

The post What Caused The Mid-Day Selloff? appeared first on Sevens Report.

source https://sevensreport.com/caused-mid-day-selloff/

Thursday, 27 July 2017

FOMC Takeaways, July 27, 2017

FOMC Preview: Get the simple talking points you need to strengthen your client relationships with a free trial of The Sevens Report.

FOMC Decision

• As expected, the Fed left rates unchanged and did not alter its balance sheet.

Takeaway

The Fed decision met our “What’s Expected” scenario, as the Fed said balance sheet reduction “relatively soon,” which is Fed speak for September.

To boot, as was also generally expected, the Fed slightly downgraded the outlook for inflation, saying that inflation was running “below 2%,” as opposed to the previous “running somewhat” below 2%. It’s a minor change that largely reflects the Fed’s recent cautious language on inflation. However, the Fed said that risks to the recovery remained “roughly balanced,” which is Fed speak for “We still can hike rates at any meeting.” That last point is important, because risks remaining “roughly balanced” leaves a rate hike in December on the table (Fed fund futures odds have it at 50/50).

Currency and bond markets reacted “dovishly” to the decision, but again that’s due more to a Pavlovian dovish response to any Fed decision rather than an accurate reflection of the Fed yesterday. In reality, the Fed wasn’t materially dovish.

Bottom line, the policy outlook remains the same: The Fed will reduce its balance sheet in September, and likely will hike rates again in December, barring any economic slowdown or further decline in inflation statistics (at which point both events will become less certain). That was the market’s expectation before the Fed meeting Wednesday, and that’s the market expectation

after the Fed decision.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

The post FOMC Takeaways, July 27, 2017 appeared first on Sevens Report.

source https://sevensreport.com/fomc-takeaways-july-27-2017/

Wednesday, 26 July 2017

Cutting Through the Political Noise: 4 Events That Could Actually Cause A Pullback, July 26, 2017

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

The political noise and theatre has officially reached a new level, with Russia, pardons, impeachment and other such terms of significant connotation being bandied about in the media seemingly every day. And if we were just reading the media headlines, it would cause someone to go into serious risk-off mode in their portfolio, especially given the tenor of the major news outlets.

But as we and others have been saying all year long, the market has so far successfully insulated itself from all the political drama, as it doesn’t have anything to do with earnings or (as of yet) the economy.

We’ve been consistent in our coverage of the political landscape, and I feel that we’ve done a good job cutting through the distracting noise. Yet given the recent uptick in political fervor across the media (including financial media), I think it’s helpful to identify, clearly, what political events could actually cause a pullback in stocks.

Absent one of four events happening (as it stands right now), politics will remain a distraction, but not a bearish influence. To be clear, we do not think any of these events are likely at this time; however, we are watching for any hints they might become more probable and cause us to reduce risk and equity exposure.

Political Pullback Event #1: Trump Fires Mueller. There are rumors and speculation swirling that President Trump will fire Robert Mueller, the special counsel in charge of the Russian election tampering investigation. So far, he is not expected to fire him, but Trump is unpredictable. If Trump were to do it, that would cause a risk-off move in markets, as everyone would take it as a tacit admission of some guilt on Trump’s part (i.e. fire the investigator before he finds something). But even if Trump wanted to fire Mueller, he actually can’t. Only the acting Attorney General can fire Mueller.

But even if Trump wanted to fire Mueller, he actually can’t. Only the acting Attorney General can fire Mueller. So first, Trump would need to fire Attorney General Sessions, and then the deputy Attorney General (Rosenstein). Then he would keep firing people until he found someone in the Justice Department that would fire Mueller. If this sounds familiar, it should, because that is what Nixon did when he fired Watergate Special Counsel Archibald Cox.

Given that history (rightly or not) people and markets would take the firing as a de facto admission of guilt that the president did something wrong, even it it’s not true. To boot, Congress would likely reappoint Mueller to the same job immediately, resulting in a massive stand off between the executive and legislative branches of the federal government. Nothing here would be positive for stocks, and a “sell first, ask questions later” mood could sweep across the markets.

Political Pullback Event #2: Steel Tariffs. The idea that the Commerce Department could impose sweeping steel tariffs (likely aimed at China) is a potential negative for markets, because it could ignite a trade war, which would be bad for US and global economic growth. Whether steel tariffs would result in retaliation from China or other nations remains to be seen, but the fact is

that macro-economic risks would rise, and once again we’d have a “sell first” reaction from stocks.

Political Pullback Event #3: Government Shutdown. We’ve covered this consistently in the report, but the current budget for the operation of the government ends on Sept. 30. Now, the probability of a shutdown remains low because the Republicans control the government. So, they’d literally shut down the government as the majority party a year ahead of elections, a move so politically stupid that it’s almost inconceivable.

However, this is Washington, and right now the budget being advanced through the House contains $1.6 billion in funding for the Mexican border wall, and a lot of cuts to domestic program. So, we can expect united Democratic opposition and (importantly) some moderate Republicans (Collins, McCain) to potentially oppose the budget, which makes passage in the Senate uncertain.

Political Pullback Event #4: Debt Ceiling. Again, this is an event we’ve already touched on in previous issues, but we’re getting a lot closer to the mid-October deadline and there’s been no progress made. Like the government shutdown, political common sense implies this won’t be a problem given it’s politically disastrous for Republicans. Congress has until mid-October to extend the debt ceiling, or face another default drama.

Time is money. Spend more time making money and less time researching markets every day—start your free trial of the Sevens Report now.

The post Cutting Through the Political Noise: 4 Events That Could Actually Cause A Pullback, July 26, 2017 appeared first on Sevens Report.

source https://sevensreport.com/cutting-political-noise-4-events-actually-cause-pullback-july-26-2017/

Tuesday, 25 July 2017

FOMC Preview and Projections plus the Wildcard to Watch, July 25, 2017

FOMC Preview: Get the simple talking points you need to strengthen your client relationships with a free trial of The Sevens Report.

Tomorrow’s FOMC meeting is important to markets for multiple reasons, because it will give us additional color on when the Fed will begin to reduce its balance sheet, and whether a December rate hike is still on the table.

Those revelations will be the latest catalyst for the ongoing battle between “reflation” (which means cyclical sectors like banks, industrials and small caps outperform) or “stagnation” (super-cap tech and defensive sector out-performance).

Given the latter sectors have been the key to outperforming the markets in 2017, understanding what the Fed means for these sectors is critically important. Remember, it was the Fed’s “hawkish” June statement

that saw Treasury yields rise and banks and small caps outperform from June through mid-July. And, it was

Yellen’s “dovish” Humphrey-Hawkins testimony that reversed the rise in yields and resulted in the two-week outperformance of super-cap tech (FDN) and defensive sectors such as utilities. So again, while not dominating the headlines, the Fed is still an important influence over the markets, just on more of a micro-economic level.

What’s Expected: No Change to Interest Rates or Balance Sheet Policy. The Fed is not expected to make any change to rates (so no hike) or begin the reduction of the balance sheet. However, and this is important, the Fed is expected to clearly signal that balance sheet reduction will begin in September by altering the fifth paragraph to state that balance sheet normalization will begin “soon” or “at the next meeting.” Likely Market Reaction: Withheld for Sevens Report subscribers. Unlock by starting your free trial today.

Hawkish If: The Fed Reduces the Balance Sheet. This would be a legitimate hawkish shock, as everyone expects the Fed to start balance sheet reduction in September. Likely Market Reaction: Withheld for Sevens Report subscribers. Unlock by starting your free trial today.

Dovish If: No Hint At Balance Sheet Reduction. If the Fed leaves the language in paragraph five unchanged (and says balance sheet reduction will happen “this year”) markets will react dovishly, as balance sheet reduction likely won’t start until after September, and that means no more rate hikes in 2017. Likely Market Reaction: Withheld for Sevens Report subscribers. Unlock by starting your free trial today.

Wild Card to Watch: Inflation Language.

So far, the Fed has been pretty dismissive regarding the undershoot of inflation, but that may change in tomorrow’s statement. If the Fed reduces its outlook on inflation (implying low inflation isn’t just temporary) or, more significantly, implies the risks are no longer “roughly balanced” (which is Fed speak for we can hike at any meeting), then a December rate hike will be off the table, and that will result in a likely significantly dovish move. If made, that change will come at the end of the second paragraph.

Bottom Line

To the casual observer, this Fed meeting might look like a non-event, but there are a lot of potential changes that could have significant implications on sector performance over the next few months. So, again, getting this Fed meeting “right” will be important from an asset allocation standpoint.

Time is money. Spend more time making money and less time researching markets every day.

The post FOMC Preview and Projections plus the Wildcard to Watch, July 25, 2017 appeared first on Sevens Report.

source https://sevensreport.com/fomc-preview-projections-plus-wildcard-watch-july-25-2017/

Monday, 24 July 2017

Weekly Market Cheat Sheet, July 24, 2017

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

Last Week in Review

The economic calendar picks up this week beginning with the flash PMI today (9:45 a.m. ET), as we continue to get an initial look at the July data. So far, the data has been a bit underwhelming as both the Empire and Philly Fed surveys came in light last week.

As far as hard data goes, Durable Goods comes out Thursday, and the preliminary second-quarter GDP number comes out Friday.

Housing data also picks up this week, and after last week’s mixed results (remember the Housing Market Index missed but Housing Starts was solid) economists will be looking for a better read on the current status of the real estate market. The two big reports this week are Existing Home Sales on Monday, and New Home Sales on Wednesday. However, the S&P CoreLogic Case-Shiller HPI also will be worth watching (due out Tuesday). If the housing data is more in line with the strong Housing Starts data we saw last week, that will be an underlying positive for the economy and supportive for risk assets near term.

Turning to the central banks, the FOMC meets Tuesday and Wednesday, and the meeting will be concluded with an announcement on Wednesday at 2:00 p.m. There are no material changes expected to come from the meeting, and it would be a shock if rates were not left unchanged. There is no press conference or forecasts released with this meeting, but language in the statement will be closely watched for any further clues on the Fed’s plans to reduce the balance sheet, or on when rates will be raised. Right now, expectations are for a December hike, but based on the trend in other central bank rhetoric the risk is for a dovish development due to the complete lack of inflation acceleration.

This Week’s Preview

Economic data was thin last week, but we did get our first look at July data in the form of regional Fed outlook surveys as well as a few reports on the housing markets.

Beginning with the Fed surveys, the Empire State Manufacturing Survey was released on Monday, and despite the bad headline it was not a terrible report. The headline missed estimates (9.8 vs. E: 15.0), but the forward looking New Orders component remained solidly above 13. The reason the report was not that bad was the fact that it had started to run hot at unsustainable level recently, and was due for a dip. And the correction we saw in the June data wasn’t too deep, and the details remained encouraging.

The Philly Fed Survey out on Thursday was not as bad a miss as the Empire data on the headline (19.5 vs. E: 22.0), but the details definitely dimmed the outlook for the Mid-Atlantic manufacturing sector. The forward-looking component of the report, New Orders, fell more than 20 points to just 2.1. The survey Philly data last week finally started to show a decline in enthusiasm from the extremely strong survey reports we’ve seen since the election. If these reports are foreshadowing a pullback in the broader US economy, that would be very bad for stocks, as solid growth is still priced into the market at current levels.

Housing data was mixed last week as the Housing Market Index missed expectations, but Housing Starts and Permits were very solid. Data on the real estate market has been all over the place recently, and it will take more data to try to decipher where the trends actually are in the sector. But if the strong Starts and Permits data from last week are any indication (this is a more material data point than the Housing Market Index) that will be a sign of confidence in the US economy.

Lastly, jobless claims were very solid last week as new claims fell back towards a four-decade low. The very positive weekly report was significant, because the data collected corresponds with the survey week for the July BLS Employment report. So, based on jobless claims alone we can expect another very strong official employment report early next month.

Time is money. Spend more time making money and less time researching markets every day.

The post Weekly Market Cheat Sheet, July 24, 2017 appeared first on Sevens Report.

source https://sevensreport.com/weekly-market-cheat-sheet-july-24-2017/

Friday, 21 July 2017

ECB Announcement Takeaways—July 21, 2017

The Sevens Report is everything you need to know about the markets in your inbox by 7am, in 7 minutes or less. Start your free two-week trial today and see what a difference the Sevens Report can make.

ECB Announcement Takeaways

- The ECB left key interest rates unchanged.

- The monthly QE program remains 60B euros

- Forward guidance was left unchanged from the June statement.

Takeaway

As expected, the ECB left all major policy decisions as they were at the July meeting, including interest rates, QE and a lack of any material new forward guidance. The initial reaction to the statement was dovish, as policymakers appeared to simple “kick the can” toward the September meeting.

But, Draghi’s press conference following the statement offered more mixed signals. First, the ECB President reiterated his upbeat view of the European economy, which is slightly hawkish, but did mention that he and other policymakers remain cautious about the lack of inflation. To that point, Draghi repeated his pledge to increase QE in both size and duration should the economy falter or financial conditions worsen. This was largely expected, but it offered a dovish reminder. At this point in the press conference, the release was still a wash.

The catalyst for the surge in the euro, which gained well over 1% in intraday trade, was actually due to the lack of attention Draghi gave to the recent strength in the currency. He had several opportunities to address the recent gains in the euro, which hit multi-year highs earlier this week.

Yet the failure to do so was enough for currency traders to chase the shared currency up to new highs.

Bottom line, the ECB effectively “kicked the taper can” to the September meeting, which means unless Draghi verbally suggests otherwise between now and then, any changes will likely be very subtle (i.e. modest taper to QE but extended duration). That was underscored by the fact that the 10-year bund was essentially unchanged yesterday. Looking ahead, the ECB still is a long way off from actually tightening policy (as they are technically still actively easing with their QE program) and as such, the rally in the euro is getting a bit extended. Nonetheless, the trend remains bullish for the euro, and until there is a catalyst such as blunt, less-dovish commentary from Draghi or a spike in EU inflation, then the path of least resistance will remain higher for the euro.

Help your clients outperform markets with The Sevens Report. Start your free two-week trial today.

The post ECB Announcement Takeaways—July 21, 2017 appeared first on Sevens Report.

source https://sevensreport.com/ecb-announcement-takeaways-july-21-2017/

Thursday, 20 July 2017

Oil Update & What It Means for the Market – July 20, 2017

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets.

Yesterday’s weekly inventory report from the EIA was universally bullish on the headline level as there were sizeable draws in crude oil stockpiles as well as in the refined products. The market responded favorably to the supply drops and WTI futures finished the day up 1.61%.

Beginning with those aforementioned headlines, commercial crude oil stocks fell –4.7M bbls last week, larger than analysts expectations of –3.1M and opposite from the API report that showed a build of +1.628M bbls.

Gasoline supply fell –4.4M bbls yesterday, and while that was less than the draw reported by the API (-5.4M) it was much larger than the average analyst estimate of –600K bbls.

Distillate inventories also fell –2.1M vs. (E) -700K rounding out a broadly bullish set of headlines in the report.

The details of the report however, once again showed a continuation in the bearish trend of rising US production. Lower 48 production (which filters out the seasonally volatile Alaskan data) rose another +30K b/d last week, above the 2017 average pace of +26K b/d to

8.97M b/d. Lower 48 production is now up +729K b/d so far in 2017, the highest level since late July 2015.

Bottom line, a string of supply draws over the last three weeks in crude oil and gasoline stocks totaling –18.6M bbls and –9.8M bbls, respectively, has offered the market some support, and helped curb a decline that pushed oil prices down to new 2017 lows. And with sentiment being very bearish coming into the month of July, the market was due for an upside correction. But, the underlying fundamentals remain bearish and as of now, we believe this is a counter-trend rally in an otherwise still broadly downward trending energy market. We won’t fight the rising tide, and a run at $50/barrel in WTI is very plausible, but we will be looking for signs of the trend to break in the weeks ahead and for the market to turn back lower based on fundamentals, market internals (term structure), and longer term technicals.

Help your clients outperform markets with The Sevens Report. Start your free two-week trial today.

The post Oil Update & What It Means for the Market – July 20, 2017 appeared first on Sevens Report.

source https://sevensreport.com/oil-update-means-market-july-20-2017/

Wednesday, 19 July 2017

Gold and Real Interest Rate Update—What It Means for the Economy, July 19, 2017

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

Gold rallied 0.67% Tuesday, as political angst spurred a fear bid while strength in the Treasury market continued to help the “real-rate” argument for gold. British inflation data missed expectations, and that was the third release since Friday that showed below-expected price pressures.

That trend helped fuel dovish money flows, which ultimately bolstered the case for gold, because a lower pace of inflation changes the narrative of the world’s central banks. It’s also cause for recalculation of the real interest rate equation (which is simply interest rates minus inflation rates equals real rates).

If real interest rates are actually poised to move lower (as nominal rates fall and inflation remains flat/does not accelerate) that will be bullish for gold and the rest of the precious metals, as they are safe-haven assets that do not offer yield.

For now, we remain neutral on gold due to the technical support violation in early July. Looking ahead, it’s all about the fundamentals, which come back to real rates.

If real rates continue to fall, even because of soft inflation causing a slightly dovish shift in central bank expectations, that will be bullish for gold long term.

From a broader standpoint, if real rates fall further, that will mean that the economy is struggling, or at the very least not meeting expectations. That will be a concern for stock investors, and ultimately holding gold allocations would be a sound hedge against volatility.

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets.

The post Gold and Real Interest Rate Update—What It Means for the Economy, July 19, 2017 appeared first on Sevens Report.

source https://sevensreport.com/gold-real-interest-rate-update-means-economy-july-19-2017/

Tuesday, 18 July 2017

Chinese Data Recap and What it Means for Global Markets, July 18, 2017

The Sevens Report is everything you need to know about the markets in your inbox by 7am, in 7 minutes or less. Start your free two-week trial today—see what a difference the Sevens Report can make.

Chinese Economic Data

- GDP held steady at 6.9% vs. (E) 6.8% in Q2

- Fixed Asset Investment was 8.6% vs. (E) 8.4% in June

- Industrial Production rose to 7.6% vs (E) 6.5% in June

- Retail Sales rose to 11.0% vs. (E) 10.6% in June

Takeaway

The headlines tell the story of yesterday’s data dump in China. The reports were universally better than expected, but GDP was the report that warranted the most attention as the headline growth rate held steady at 6.9% rather than pulling back as expected.

Quarter-on-quarter growth jumped to 1.7% from 1.3%, which suggests that the Chinese economy is starting to stabilize towards the top end of the government’s target range of 6.5%-7%.

Looking ahead, the solid growth level seems to be sustainable, and not just a short-lived spike in economic activity. Without getting deep into the details, the growth is consumption driven, and new government policy and reforms are poised to help continue fueling solid growth into H2’17.

Bottom line, yesterday’s strong set of Chinese economic reports were welcomed by economists, as they underscored the positive outlook for the global economy going forward. But the reason the data did not ignite a more pronounced rally in global equities is the fact that growth in China has become more of an expectation, and global growth as a whole is no longer a great concern (as it was back in the summer of 2015).

Instead, very low inflation rates in the US and Europe are the most notable concern, and until those statistics begin to firm, weak inflationary pressures will be a drag on risk assets like stocks in the months ahead.

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets.

The post Chinese Data Recap and What it Means for Global Markets, July 18, 2017 appeared first on Sevens Report.

source https://sevensreport.com/chinese-data-recap-means-global-markets-july-18-2017/

Monday, 17 July 2017

Weekly Market Cheat Sheet, July 17, 2017

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial with no obligation, just tell us where to send it.

Last Week in Review

Hard economic data continued to disappoint last week, as both inflation and economic growth statistics were a letdown. And while in the short term the markets embraced it, as it potentially makes the Fed less hawkish, longer term this is a potential problem as we need economic acceleration and higher inflation to power stocks materially higher.

Friday’s CPI report was the focus last week, as inflation has consistently been losing momentum since early 2017, and unfortunately that trend continued in June. Core CPI, which is the important metric in the report, rose 0.1% vs. (E) 0.2%, and 1.7% yoy. That continued a now four-month slowing of inflation, and unless this changes in the next month or two, it could alter expected Fed policy.

Specifically, while Friday’s disappointing data prompted calls from analysts to say the Fed won’t hike rates or reduce the balance sheet in September, we think that is premature. I believe it would take a material slowing of economic growth to cause the Fed not to start shrinking the balance sheet, and that is not what happened last week. With regards to rate hikes, if the inflation data doesn’t get better between now and October, then yes, the Fed will probably be on hold for a while. But, there’s a lot of time between now and October (think about how much changed during this period last year, when economic growth accelerated).

Looking at the other data last week, June Retail Sales was easily the most disappointing report. The “control” group (which is the key metric in the report, and reflects Retail Sales minus gas, autos and building materials) dropped to -0.1% vs. (E) 0.4%, and that is a potentially cautious signal for consumer spending.

Finally, Industrial Production looked like the one decent number last week, as the headline beat estimates at 0.4% vs. (E) 0.1%. However, it was a bump in mining activity that caused the headline to surge, and the more important manufacturing sub component just met expectations at 0.2%. Bottom line, last week’s data was a disappointment, and further confirmed the unsustainably wide gap between “hard” economic numbers and “soft” economic surveys (like the manufacturing PMIs), and that gap must be filled one way or the other.

From a market standpoint, in the short term the data will have a dovish effect. Longer term, this middling data is a threat. With global central banks becoming less dovish, economic growth must accelerate, and in the US that isn’t happening. Long term, that’s a problem for stocks.

This Week’s Preview

There are several notable economic reports out this week, including first looks at July economic activity, as well as the ECB meeting. But unless there are major surprises, the data shouldn’t really move the debate about reflation vs. stagnation.

The headline event this week is the ECB meeting, which comes Thursday. Other than parsing Draghi’s comments for hawkish or dovish hints, there shouldn’t be any surprises at this meeting. For the ECB, the outlook is they will announce tapering of the QE program at the September meeting, and that by mid-2018, ECB QE will be over. Nothing Thursday should change that expectation.

Looking at US data, we get our first look at July activity via the Empire Manufacturing Survey (today) and the Philly Fed Survey (Thursday). While anecdotally notable, both surveys haven’t been well correlated to the national manufacturing PMIs lately, and as such they aren’t likely to elicit much of a market reaction barring a big surprise.

Bottom line, this week’s economic events will give us more anecdotal insight into the current state of the economy, but really, it’s next week’s data (flash manufacturing PMIs) that’s the next potential market mover.

Get the simple talking points you need to strengthen your client relationships with the Sevens Report. Everything you need to know about the markets delivered to your inbox by 7am each morning, in 7 minutes or less.

The post Weekly Market Cheat Sheet, July 17, 2017 appeared first on Sevens Report.

source https://sevensreport.com/weekly-market-cheat-sheet-july-17-2017/

Friday, 14 July 2017

Earnings Season Preview, July 13, 2017

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets.

Earnings remain an unsung, but very important tailwind on the markets, in part because both 2017 and 2018 earnings keep getting revised upward. And since stock prices are just a total of future expected earnings, those higher earnings are resulting in higher stock prices.

Given Q2 earnings season begins today, I want to take a moment and cover 1) What’s expected, and 2) How earnings can be a catalyst for a pullback, or 3) Spark a new rally.

First, to give some perspective, what’s important here is to look at the aggregate S&P 500 calendar-year earnings. Think of it as if you got the full-year earnings estimates for all 500 companies, and then added them up.

For 2017, that number (and this is an average between FactSet and Bloomberg consensus) is $131.00/share. So, on a current-year basis, the S&P 500 is trading at about 18.7X earnings (2450/131.00). That is a very historically high multiple, but not, by itself, prohibitively expensive.

For 2018, the consensus headline earnings (again an average of FactSet and Bloomberg) is $146.46. However, you have to take next year’s earnings estimates with a grain of salt, as they almost always come down throughout the year by around 5%-10%. There are multiple and varied reasons for this, but just trust me that is what happens.

So, if we reduce the $146.46 by 5%, we get $139.13. (I’m reducing it by just 5%, because corporate performance has been strong and my general caution aside, there aren’t any specific events looming out there, at this point, that should really hit corporate earnings).

At $139.13, the S&P 500 is trading at 17.6X next year’s earnings (2018). Most analysts (including me) consider 18X the “ceiling” for a next year P/E multiple. So, the markets is trading close to what most would consider a valuation “ceiling,” but it’s not there quite yet. And, given this set up, I think there are a few notable conclusions that need to be drawn from this analysis.

First, in order for this market to move higher, we must not see that $139ish 2018 S&P 500 number go down following this earning’s season. If it does, this market instantly becomes too expensive (for instance, if the expected 2018 EPS drops to $135, then the market is trading 18.15X earnings, which in my view would be too expensive).

Second, if that 2018 number moves higher following Q2 earnings season, then stocks can rally further and potentially materially so. And, we’ve seen that throughout 2017. Expected earnings for 2018 in January were in the mid $130s; however, corporate results have been stronger than expected, so that number has moved steadily higher, and that’s helped underpin the rally in stocks. If Q2 earnings season is stronger than expected and 2018 EPS get revised higher, this market can rally further and still not break above that 18X valuation ceiling.

Bottom line, for all the focus on politics, the Fed and macro factors, the real push behind the 2017 rally has been earnings growth. In 2017, the S&P 500 is expected to earn $131/share. In 2018, it’s expected to earn $139/ share. That’s at least 6% earnings growth with upside risks. So, until something in the macro economy puts that earnings growth at risk (like materially higher yields, geopolitical scare, turn in US & global economic data) the fact remains that while the stock market is historically expensive, it’s not prohibitively so.

Getting this earnings season “right” from a valuation standpoint will be an important signal on whether we need to reduce exposure, or allocate more to equities. We will be watching, and as soon as we get enough numbers to get some confidence on 2018 earnings, we will let you know.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

The post Earnings Season Preview, July 13, 2017 appeared first on Sevens Report.

source https://sevensreport.com/earnings-season-preview-july-13-2017/

Thursday, 13 July 2017

3 Times Yellen Wasn’t that Dovish in Her HFSC Testimony, July 13, 2017

Cut through the noise and understand what’s truly driving markets. The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Start your free two-week trial today.

Markets interpreted Fed Chair Yellen’s comments to theHouse Financial Services Committee (HFSC) on Wednesday as dovish, and stocks rallied. However, I think that interpretation is more based on the markets’ perma-dovish expectation, and not the reality of her actual comments.

Broadly, the market confirmed that opinion, as the dollar was higher following her remarks. And though bond yields and banks did decline, the respective drops weren’t bad, especially considering the recent run up in yields and bank stocks. If Yellen was really dovish I would have expected the 10-year Treasury yield to fall sharply. Instead, it just drifted lower.

As I saw it, Yellen was broadly neutral, and most importantly, didn’t do anything to alter the expectation that the Fed will reduce the balance sheet in September and hike rates in December. To prove that point, I want to review the three lines of text the media focused on to spin Yellen’s testimony as dovish, and note they didn’t really change anything from a policy outlook standpoint.

Line 1: “Roughly equal odds that the U.S. economy’s performance will be somewhat stronger or somewhat less strong than we currently project.” I suppose that is less optimistic than if she said, “I think risks to the economic forecast are skewed higher.” But just because she didn’t say that doesn’t mean it’s a dovish statement.

More to the point, Yellen wouldn’t imply risks are skewed higher because 1) It’s probably not true (data hasn’t been great so far in 2017) and 2) She knows she’d spike yields. Additionally, to focus on that one statement is a bit of cherry picking, as Yellen made multiple positive mentions about the acceleration of economic growth.

Line 2: “Rates Won’t Have to Rise Much Further To Get to Neutral.” First, that’s nothing new. We know the Fed’s “neutral” interest rate level is very low (likely below 3%). Second, she continued by saying the “neutral” rate will rise over time as the economy gets better. So, as the neutral rate rises, so too will interest rates. Again, nothing new, and not dovish on its face.

Line 3: “There is—for example, uncertainty about when—and how much—inflation responds to tightening resource utilization.” First, tightening resource utilization is Fed speak for a tight jobs market. So, “responds to tightening resource utilization” is just the idea that rising wages (which are the result of a tightening labor market) causes broad-based inflation. Translation, Yellen said, “I don’t know when low unemployment will cause inflation, or how high inflation will get.”

Importantly, Yellen admitted we didn’t know “when” or “how much” inflation would rise given low unemployment, but she didn’t imply we don’t know “if.” Point being, her comments imply it will happen, it’s just un-clear when or how big it will be. Again, nothing new… and not dovish.

Bottom Line

Broadly, investors also focused on Yellen’s repeated mention of low inflation, which makes me think Friday’s CPI report could be soft, but to extrapolate out her comments as a dovish shift is too aggressive at this point.

The post 3 Times Yellen Wasn’t that Dovish in Her HFSC Testimony, July 13, 2017 appeared first on Sevens Report.

source https://sevensreport.com/3-times-yellen-wasnt-dovish-hfsc-testimony-july-13-2017/

Wednesday, 12 July 2017

How Politics is Impacting the Market—Update, July 12, 2017

Cut through the noise and understand what’s truly driving markets, as this new political and economic reality evolves. Get your free two-week trial of The Sevens Report: Everything you need to know about the market in your inbox by 7am, in 7 minutes or less.

Politics interjected itself into the markets Tuesday, this time via a release of emails from Donald Trump Jr. regarding his meeting with Russian surrogates. But that wasn’t the only news out of Washington yesterday, as Senate Majority Leader McConnell has cut short the August recess to work on healthcare.

While those two issues dominate the media, the really important Washington-related events (from a market standpoint) continue to be largely ignored. So, I wanted to take a moment and provide a another Political Update.

Issue 1: Russia

Potential Market Impact: Not very big unless something substantial changes.

As has been the case for months, this topic dominated the headlines and drowned out almost everything else in the markets Tuesday.

But, as has also been the case, from a market standpoint the whole Russia subject remains much more of a media issue than a markets issue. I don’t say that to minimize any opinion you might have on the matter, but the fact is that until there is irrefutable evidence that Trump (or Trump’s team via direction from Trump) acted explicitly to interfere with the election outcome or break some other law, impeachment or removal of Trump remains an extremely remote possibility. Again, that’s because impeachment is a political, not a judicial, process, and it’ll take a lot for Republicans to impeach a sitting Republican President (and the same goes for Democrats).

Going forward, this Russia issue clearly isn’t going away as the Trump Jr. emails, while not directly incriminating, aren’t exactly exonerating, either. For now, any “Russia” dips should be bought.

Issue 2: Healthcare Bill

Potential Market Impact: Positive if the Healthcare Bill Fails

Looking elsewhere in Washington, Senate Majority Leader McConnell cancelled much of the Senate’s summer holiday when he delayed the start of August recess until August 14, giving our good public servants just three weeks off, as opposed to the normal five or six. The ostensible reason for the removal of the recess is to work on the healthcare bill, which at this point appears all but dead.

From a market standpoint, healthcare is only really important due to it’s effect on tax cuts. In many ways, markets want healthcare to fail, and fail quickly, so that Republicans can focus solely on tax cuts. To boot, if healthcare fails, it’s almost a certainty that Republicans will exit 2017 with almost no legislative accomplishments, so the pressure will be on to cut corporate taxes in 2018… especially given it’s an election year.

The bottom line with healthcare is this: Passage of an Obamacare repeal/replace bill still looks slim, but that’s ok for markets as long is it doesn’t endanger tax cuts in 2018. At this point, the sooner Republicans move on taxes, the better, so don’t be surprised by a relief rally if the healthcare bill officially fails in the Senate.

Issues 3 & 4: Debt Ceiling Extension & Government Shut-down

Potential Market Impact: Very negative.

The media is so myopically focused on Trump and healthcare that it’s largely ignoring the actual important, Washington-related events in 2017, which are the debt ceiling and government shutdown.

The debt ceiling must be extended by early October while the current government spending bill ends on Oct. 1 (if another spending bill isn’t passed, the government shuts down).

Now, the probability of either event happening is slim, because Republicans control Congress and the White House, and that would be the quintessential shooting of oneself in the foot. However, that doesn’t mean we won’t walk right up to the line again and give everyone a scare.

Bottom line, Washington remains much more bluster than bite for markets, but we are getting close to events that could actually move markets. Regardless of the headlines and sensationalism, the key is to look past the noise and stay focused on that debt ceiling and government shutdown in late-September/early October. That’s really when Washington might (rightly) begin to weigh on stocks.

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Start your no obligation two-week trial today.

The post How Politics is Impacting the Market—Update, July 12, 2017 appeared first on Sevens Report.

source https://sevensreport.com/politics-impacting-market-update-july-12-2017/

Tuesday, 11 July 2017

Momentum Indicator Update, July 11, 2017

Get the simple talking points you need to strengthen your client relationships with a free trial of The Sevens Report.

About two months ago, as markets were grinding relentlessly higher despite underwhelming economic fundamentals, I identified four momentum indicators that would tell us when this market was losing momentum and when the chances for a pullback were rising.

Those four indicators were: 1) Consumer sentiment, 2) NYSE Advance/Decline line, 3) Semiconductors (SOXX) and 4) Super-cap internet (FDN).

Over the subsequent eight weeks, three of those four indicators have remained broadly positive. Only semiconductors have lost momentum (SOXX hit multi-month lows in Thursday’s selling). But while the three remaining momentum indicators are still giving positive signals, recently there have been some signs of fatigue.

First, FDN (First Trust DJ Internet Index Fund) held the June lows, but it’s stuck in a range currently and can’t seem to break to a higher high.

Second, the NYSE Advance/Decline line is sitting on an uptrend in place since late-February 2016, and if we get any sort of a nasty sell-off in the next few days (like we saw last Thursday) that trendline could break.

Finally, looking at consumer sentiment, unending skepticism towards this now eight-year-long rally remains its most consistent fuel; however, that may finally be changing.

Retail investor sentiment indicators remain overly cautious. The American Association of Individual Investors Bulls/Bears Sentiment is cautious, as there is just 29.6% bulls vs. a historical 38.5%. But, in a notable change, the number of bears also is below average (29.9% vs. the average of 30.5%).

The difference is made up in the “Neutral” category, which has surged to 40.6% vs. an average of 30.5%. Now, that’s not overtly bullish, but it anecdotally reflects the idea that you simply “must” be invested as they market grinds higher. And, that idea is in line with a recent similar reading from institutional investors.

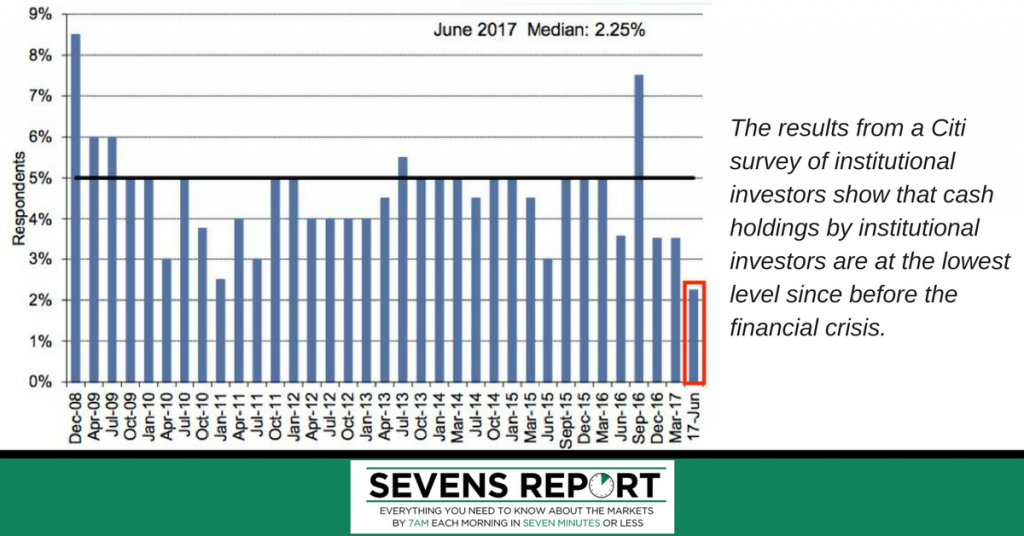

Yesterday, I read a survey from Citi that showed institutional investors are holding their lowest levels of cash since before the financial crisis! According to survey respondents, in June the median cash holdings for institutional investors was just 2.5%, down sharply from the 7.5% level at the end of September 2016. That’s the lowest level of cash on hand since before the financial crisis.

Now, one statistic doesn’t mean an impending market pullback, but this survey data does generally correspond to the idea that the TINA trade (There is No Alternative to stocks) has finally, and begrudgingly, pulled the remainder of cash off the sidelines and into the market.

And, as history has taught us, we can all guess what happens next.

Regardless, the major point I’m trying to make here is this: We’re nearing a pretty substantial tipping point in markets, and while both the bulls and bears have points of evidence on their side, the benefit of the doubt remains, for now, with the bulls. Still, we need a continuation of the recent better economic data and better inflation numbers to power this market higher, otherwise the chances of some sort of a pullback will indeed rise.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

The post Momentum Indicator Update, July 11, 2017 appeared first on Sevens Report.

source https://sevensreport.com/momentum-indicator-update-july-11-2017/

Monday, 10 July 2017

Weekly Market Cheat Sheet, July 10, 2017

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial with no obligation, just tell us where to send it.

Last Week in Review:

Reflation on? Not just yet, but last week’s data did imply that the US economy may be starting to gain more positive momentum, which will be much to the Fed’s relief after looking past recent soft economic data. Specifically, every major economic data point released last week beat expectations, and some handily so.

Before getting to those numbers, it’s important to address the biggest market-moving event last week: The ECB meeting minutes. Anticipation of those minutes, which were mildly hawkish, caused the German bund yield to break to a multi-year high above 0.5%, and that caused an acceleration in the decline in bonds/rise in yields that ultimately resulted in the 1% decline in stocks last Thursday.

The importance of the ECB minutes (and largely all the data from last week) was that it confirmed central banks do expect better growth and inflation, and that expectation is leading them to get less dovish, which is sending global bond yields higher.

The bottom line for the ECB and the Fed remains 1) The ECB is expected to begin to taper QE in January 2018, and end it completely in mid-2018, while the Fed is expected to begin to reduce the balance sheet in September, and hike rates again in December. The events of this week reinforced those expectations, which are largely priced into stocks and bonds at this point.

Turning to the economic data, it was good last week. The jobs report was the highlight, and it was strong. Job adds in June were 222k, solidly above the 170k estimate. However, wages were a slight disappointment, up just 0.2% and 2.5% yoy, which stopped the strong jobs report from being “Too Hot.”

Looking at the other two key numbers last week, the June ISM Manufacturing PMI and ISM Non-Manufacturing PMI, they also were strong. The Manufacturing PMI surged to the best level since August 2014, rising to 57.8 vs. (E) 55.1 while the Non-Manufacturing (or service sector) PMI rose to 57.4 vs. (E) 56.5. Details of both reports were also strong, as New Orders rose, suggesting continued momentum into the summer.

To a point, the data can be taken with a grain of salt, because there’s no question the jobs market remained strong in June (the weekly claims told us that) while the PMIs are still just “soft data” in so much as it’s survey data, and not hard economic data. Still, these numbers were good, and it does reinforce that we are seeing an emerging reflation in the economy, and an emerging reflation trade in markets.

This Week’s Preview:

Normally after the jobs report the following week is pretty quiet on the economic front. Yet that’s not so this week, as we get three very important economic numbers Friday.

June CPI is the highlight of the week, and it will be an important number for markets given the recent rise in yields. Since the Fed and other global central banks expressed surprising confidence in their respective economies in June, economic data has largely reinforced that expectation.

However, now it’s inflation’s turn. If inflation metrics show a further loss of momentum, that will undercut central bank’s expectation of future inflation, and could cause at least a mild reversal in the recent reflation trade (so bond yields down, banks/small caps/cyclicals down, defensives/tech up). Conversely, if CPI is strong, it will further prove central banks were right to look past the soft data, and the reflation trade will likely accelerate. So, this will be an important number regarding sector trade, and near-term performance in the broad market.

Also on Friday we get June Retail Sales and June Industrial Production. As previously mentioned, there is still a gap between soft, survey-based data (the PMIs) and hard, actual economic numbers. Given the strength in the PMIs, expectations for better actual economic data via Retail Sales and Industrial Production now is somewhat expected.

Finally, Fed Chair Yellen gives the second of her Humphrey-Hawkins testimonies this week, and she will address the Senate Banking Committee on Wednesday and the House Financial Services Committee Thursday. The tone of her comments will obviously be closely watched, but with several years on the job, Yellen seems to have learned not to give anything away in these testimonies. Yet if her tone echoes the confidence in the economy and inflation that we saw in the June FOMC meeting, it will be at least a mild reinforcement of the reflation trade across assets (i.e. higher yields).

Get the simple talking points you need to strengthen your client relationships with the Sevens Report. Everything you need to know about the markets delivered to your inbox by 7am each morning, in 7 minutes or less.

The post Weekly Market Cheat Sheet, July 10, 2017 appeared first on Sevens Report.

source https://sevensreport.com/weekly-market-cheat-sheet-july-10-2017/

Friday, 7 July 2017

What Does “Reflation” Actually Mean?, July 7, 2017

What Does “Reflation” Actually Mean?

One of the reasons I started the Sevens Report more than five years ago was because I hated the overuse of jargon by analysts and commentators. Frankly, markets and economics are not particularly complicated topics. There are a lot of variables involved, so getting the future right is difficult. However, understanding market dynamics and economic conditions is actually mostly common sense, because markets and economies are just the sum of collective actions by people. And, since people generally act in their own best interests, it’s not too difficult to understand markets and economics once you get past the jargon.

To that point, I’ve found myself using the terms “reflation” and “cyclical” entirely too much lately. That’s jargon, and I want to make sure that everyone knows exactly what I mean when I say “reflation trade” or “cyclical outperformance.”

So, what is Reflation?

Reflation is simply the idea that economic growth is going to accelerate in the future. To understand why we use the term reflation, think of the economy as a soccer ball. The ball is full of air when we have consistent 3% GDP growth. But, fallout from the financial crisis has put GDP growth around 2% for nearly a decade. So, the soccer ball (i.e. the economy) is deflated.

However, if we see economic acceleration back to consistent 3% growth, the ball (i.e. the economy) has been “reflated.” So, any economic news that implies better growth is termed “reflation.”

And, since reflation is just the expectation of an accelerating economy, people (i.e. investors and the market) react to that expectation. That reaction, typically, is comprised of:

1) Selling bonds (so higher rates) because in an accelerating economy central banks hike rates and inflation rises, both of which are negative for bonds.

2) They allocate investment capital to sectors of the economy that are more reactive to better economic growth.

These sectors are called cyclicals, because their profitability rises and falls with economic growth (like a cycle). Banks (better economy=more demand for money), industrials (better economy=capital investment in projects), small caps (better economy=rising tide for products and more availability of capital), and consumer discretionary (better economy=more spending money) all are cyclical sectors.

Companies in those sectors usually make more money when the economy is getting better, and the anticipation of that attracts capital at the expense of bonds and “non-cyclical” sectors such as utilities, consumer staples, healthcare, and, increasingly, super-cap tech.

Up until June, the non-cyclicals outperformed because there was no evidence of higher rates or better growth. But in June central banks sent a shot of confidence into the markets, and since then, in anticipation of that economic acceleration, cyclical sectors have outperformed. And, if today’s jobs report is strong, beyond any short term “Taper Tantrum 2.0” that’s likely a trend that will continue, especially given the trend change in bonds.

Skip the jargon, arcane details and drab statistics from in-house research, and get the simple analysis that will improve your performance. Get the simple talking points you need to strengthen your client relationships with a free two-week trial of The Sevens Report. No credit card needed, no commitment—just tell us where to send it.

The post What Does “Reflation” Actually Mean?, July 7, 2017 appeared first on Sevens Report.

source https://sevensreport.com/reflation-actually-mean-july-7-2017/

Thursday, 6 July 2017

Goldilocks Jobs Report Preview, July 6, 2017

Goldilocks Jobs Report Preview: What Will Make the Report too Hot, too Cold, or Just Right?

Given the Fed’s newfound confidence in inflation and economic growth, the bigger risk for stocks will be if tomorrow’s number comes in “Too Cold,” and further implies the economy is losing momentum into a hiking cycle.

However, while a “Too Cold” scenario would likely be the worst outcome for stocks, “Too Hot” wouldn’t be ideal, either, as it would cause a resumption of the reflation trade we saw in June.

So, there are two-sided risks into tomorrow’s jobs report, and if it’s outside of the “Just Right” scenario, we will either see some important sector rotation, or a broader market movement.

“Too Hot” Scenario (Potential for Two More Rate Hikes in 2017)

• >250k Job Adds, < 4.1% Unemployment, > 2.9% YOY wage increase. A number this hot will open the discussion for another rate hike, likely in September or November.

Likely Market Reaction: We should see a powerful reengagement of the “reflation trade” from June… (withheld for subscribers only—unlock specifics and ETFs by signing up for a free two-week trial).

“Just Right” Scenario (Confirms expectations of September balance sheet reduction & December rate hike)

• 125k–250k Job Adds, > 4.1% Unemployment Rate, 2.5%-2.8% YOY wage increase. This is the best-case scenario for stocks, as it would reinforce the current expectation of balance sheet reduction in September, and one more 25-bps rate hike in December.

Likely Market Reaction: This is the most positive outcome for stocks… (withheld for subscribers only—unlock specifics and ETFs by signing up for a free two-week trial).

“Too Cold” Scenario (Economic Growth Potentially Stalling)

• < 125k Job Adds. The key to a sustained, longer term breakout in stocks is stronger economic growth that leads to higher interest rates, and a soft number here would further undermine that outcome, and imply the Fed is hiking rates into an economy that is losing momentum.

Likely Market Reaction: (Withheld for subscribers only—unlock specifics and ETFs by signing up for a free two-week trial).

Again, given the Fed and other central banks newfound hawkishness, this is the worst outcome for stocks over the coming weeks and months.

Bottom Line

This jobs report isn’t important because it will materially alter the Fed’s near-term outlook. Instead, it’s important because if it prints “Too Cold” it could send bonds and bank stocks through their 2017 lows. And while I respect the fact that stocks have been able to withstand that underperformance so far in 2017, I don’t think the broad market can withstand new lows in yields and banks.

Cut through the noise and understand what’s truly driving markets, as this new political and economic reality evolves. The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Sign up for your free two-week trial today and see the difference 7 minutes can make.

The post Goldilocks Jobs Report Preview, July 6, 2017 appeared first on Sevens Report.

source https://sevensreport.com/goldilocks-jobs-report-preview-july-6-2017/

Wednesday, 5 July 2017

7 Dates That Could Make or Break the Market in Q3, July 5, 2017

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets.

The first half of 2017 was defined by historically low volatility, and one of the quietest macro calendars we’ve had in years. However, with several parts of the market and economy in flux heading into the second half of the year, we’re likely going to see an uptick in volatility, and I think we got a preview of that during June.

So, we’ve identified four key events and seven key dates associated with those events that we believe could either 1) Lead to an acceleration of the rally, or 2) Cause a reversal and substantial pullback in stocks.

We haven’t included the regular monthly economic data (Jobs reports, PMIs, Core PCE Price Index) because that’s always important, every month. Instead, the list below is comprised of events that are not typically on a quarterly calendar, and we want you to be aware of

1) What they are,

2) Why they are important, and

3) How they can move markets.

Everything we do at the Sevens Report is based around efficiency—giving you only the critical information in the shortest amount of time, so in that vain this list is organized by potential impact on markets (i.e. the first events listed have the most potential to move markets).

Q3 Market Event #1:

Q2 Earnings Season. Date: 7/17.

What It Is: Second quarter earnings season. Specifically, big banks (C, WFC, BAC, etc.) start to report earnings as early as 7/14, but the real volume of reports won’t kick in till 7/17, and that’s when things could get interesting.

Why It’s Important: As we’ve said frequently, the unsung hero of the 2017 rally is earnings expectations. Markets are expecting nearly 10% yoy earnings growth for the S&P 500 from 2017 to 2018. That means that conservatively, we’re looking at $137 or $138/share for 2018 S&P 500 EPS, and that doesn’t include a boost for any corporate tax cuts. Those rising earnings make the valuation math work for investors, as it keeps the S&P 500 at 18X 2018 earnings, the historical top for valuation levels. Without that earnings growth, the valuation math on this market won’t make sense, and we’ll get a pull-back.

How It Could Move Markets: If earnings growth looks to be slowing in Q2, that could cause that 2018 expected S&P 500 EPS to decline, to say $135ish. If that occurs, this market is too expensive, and we could easily see a 3%-5% pullback.

Q3 Market Event #2:

What It Is: Government Funding Expires. Date 9/30. What It Is: Markets have taken increasing levels of government incompetence in stride so far in 2017, but that’s only because the market still expects corporate tax cuts in 2018, and because all the noise and distraction hasn’t had any negative effect on the economy. That could change in the next few months.

Why It’s Important: First, the government must raise the debt ceiling by the fall, otherwise we’ll have another default scare. Second, the government must pass a budget to keep funding the government. If they don’t, we’ll have another shutdown scare.

How It Could Move Markets. If the drama in Washington threatens to have real, concrete implications on the markets and economy, then stocks will get hit, potentially hard.

Q3 Market Event #3:

What It Is: Fed Tightening. Date(s): 7/26, late August, 9/20. What Is It: Easily the biggest issue for mar-kets as we exit 1H ’17 is that the Fed is more hawkish than we are used to, and how that materializes over the next three months will move markets. There is a Fed meeting on July 26, and while no one expects a rate hike at that time, if bond yields remain low and financial conditions continue to ease, the Fed could try and send a message. Then, in late August, the Fed’s annual Jackson Hole conference takes place. The Fed could again try and deliver a hawkish message to markets. Finally, the September meeting on 9/20 is where the Fed is expected to begin to reduce its balance sheet.

Why It Matters: No one knows how markets will react if the Fed gets more hawkish. Bonds have been stubbornly buoyant, but that could change, and then the question is whether the rise in interest rates is gradual, or whether we get another “Taper Tantrum.” Conversely, if economic data stays uninspiring in Q3, we could have a scenario where yields are rising but economic growth is not.

How It Could Move Markets: If yields rise too quickly or economic data remains lackluster but the Fed stays on a tightening path, that could hit stocks. Conversely, if economic growth accelerates and the rise in rates is gradual, that could power a reflationary rally, led by banks, small caps and cyclicals.

Q3 Market Event #4:

What It Is: Washington Policy—Healthcare & Tax Cuts. Dates: 7/28, 9/5. What Is It: Things are coming to a head on healthcare and taxes, and over the next few months we’ll see whether the expectation for corporate tax cuts in 2018 is still reasonable. Specifically, the healthcare issue will be resolved one way or the other by July 28, as a bill will either pass the Senate, or it will be dead. Regarding taxes, the Trump administration has promised a specific tax plan by the time Congress returns from the August recess on September 5. If there isn’t something concrete by then, tax reform in Q1 ’18 (which is expected by markets) will become very difficult to achieve.

Why It Matters: Markets still expect corporate tax cuts in Q1 2018, and if that expectation proves false, then investors will reassess owning stocks at these valuations, as there won’t be a visible, positive earnings catalyst on the horizon.

How It Could Move Markets: If there is no concrete, real tax plan (and I’m talking about agreement on border adjustments, interest deductibility, etc.) then that changes the market’s valuation paradigm. Conversely, if we do get progress on this issue that will be bullish for highly taxed sectors such as retail, energy, healthcare, etc.

Bottom Line

There are real, potentially significant market-moving events in the third quarter that could easily cause a “melt up” in stocks, and turn 2017 into a banner year… or cause a nasty pullback. Because just based on the calendar, we’re due for a pullback (there’s been no real pullback since Feb. ’16). While it’d be nice if we got a continuation of the calm, levitating market we saw in the first half, given these looming events (and considering many of them are Washington oriented) it’s unlikely.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

The post 7 Dates That Could Make or Break the Market in Q3, July 5, 2017 appeared first on Sevens Report.

source https://sevensreport.com/7-dates-make-break-market-q3-july-5-2017/