Get the simple talking points you need to strengthen your client relationships with a free trial of The Sevens Report.

About two months ago, as markets were grinding relentlessly higher despite underwhelming economic fundamentals, I identified four momentum indicators that would tell us when this market was losing momentum and when the chances for a pullback were rising.

Those four indicators were: 1) Consumer sentiment, 2) NYSE Advance/Decline line, 3) Semiconductors (SOXX) and 4) Super-cap internet (FDN).

Over the subsequent eight weeks, three of those four indicators have remained broadly positive. Only semiconductors have lost momentum (SOXX hit multi-month lows in Thursday’s selling). But while the three remaining momentum indicators are still giving positive signals, recently there have been some signs of fatigue.

First, FDN (First Trust DJ Internet Index Fund) held the June lows, but it’s stuck in a range currently and can’t seem to break to a higher high.

Second, the NYSE Advance/Decline line is sitting on an uptrend in place since late-February 2016, and if we get any sort of a nasty sell-off in the next few days (like we saw last Thursday) that trendline could break.

Finally, looking at consumer sentiment, unending skepticism towards this now eight-year-long rally remains its most consistent fuel; however, that may finally be changing.

Retail investor sentiment indicators remain overly cautious. The American Association of Individual Investors Bulls/Bears Sentiment is cautious, as there is just 29.6% bulls vs. a historical 38.5%. But, in a notable change, the number of bears also is below average (29.9% vs. the average of 30.5%).

The difference is made up in the “Neutral” category, which has surged to 40.6% vs. an average of 30.5%. Now, that’s not overtly bullish, but it anecdotally reflects the idea that you simply “must” be invested as they market grinds higher. And, that idea is in line with a recent similar reading from institutional investors.

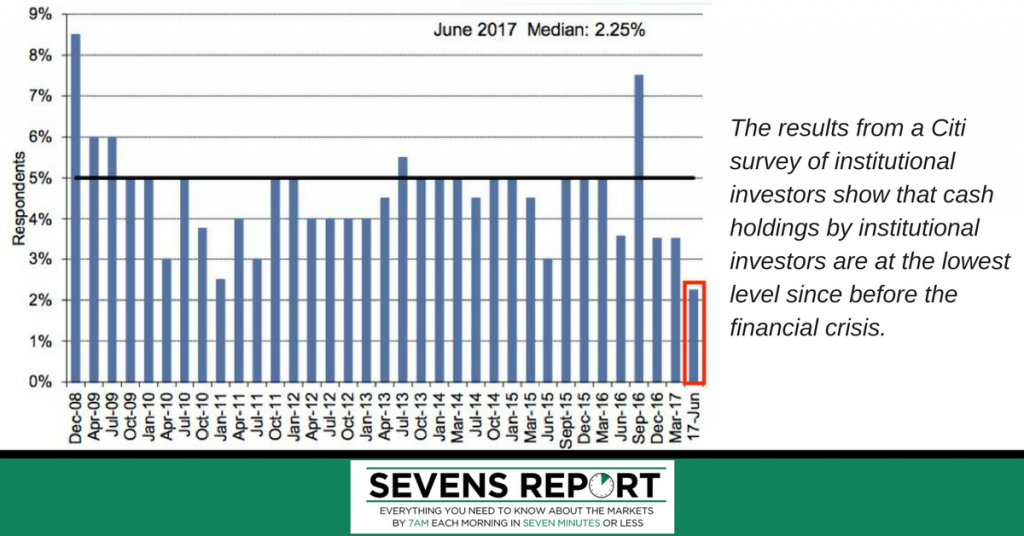

Yesterday, I read a survey from Citi that showed institutional investors are holding their lowest levels of cash since before the financial crisis! According to survey respondents, in June the median cash holdings for institutional investors was just 2.5%, down sharply from the 7.5% level at the end of September 2016. That’s the lowest level of cash on hand since before the financial crisis.

Now, one statistic doesn’t mean an impending market pullback, but this survey data does generally correspond to the idea that the TINA trade (There is No Alternative to stocks) has finally, and begrudgingly, pulled the remainder of cash off the sidelines and into the market.

And, as history has taught us, we can all guess what happens next.

Regardless, the major point I’m trying to make here is this: We’re nearing a pretty substantial tipping point in markets, and while both the bulls and bears have points of evidence on their side, the benefit of the doubt remains, for now, with the bulls. Still, we need a continuation of the recent better economic data and better inflation numbers to power this market higher, otherwise the chances of some sort of a pullback will indeed rise.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

The post Momentum Indicator Update, July 11, 2017 appeared first on Sevens Report.

source https://sevensreport.com/momentum-indicator-update-july-11-2017/

No comments:

Post a Comment